Another swing upwards – then short!

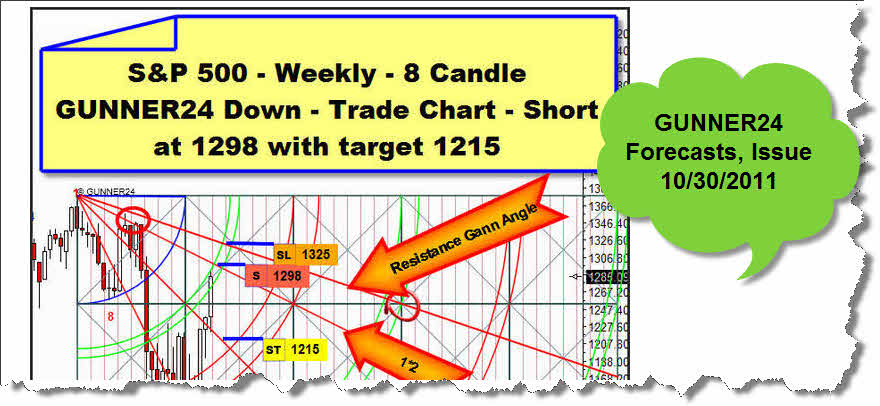

In the last GUNNER24 Forecasts we expressed our expectation of an downwards move in the stock markets for last week. The move did occur. But unfortunately the predicted high at 1298 was not reached at the beginning of the week for which we had planned the short entry. As early as on Monday opening the S&P 500 began to switch off downwards without executing the last exhaustion move to 1298 I had expected:

We had intended to go short on daily basis – with target 1215. Anyhow the down target was met… On Tuesday the market turned up again exactly at the down target with the 1*1 Gann Angle support.

With this development a last higher high of this upwards move since the October 4 seems to be in the offing now:

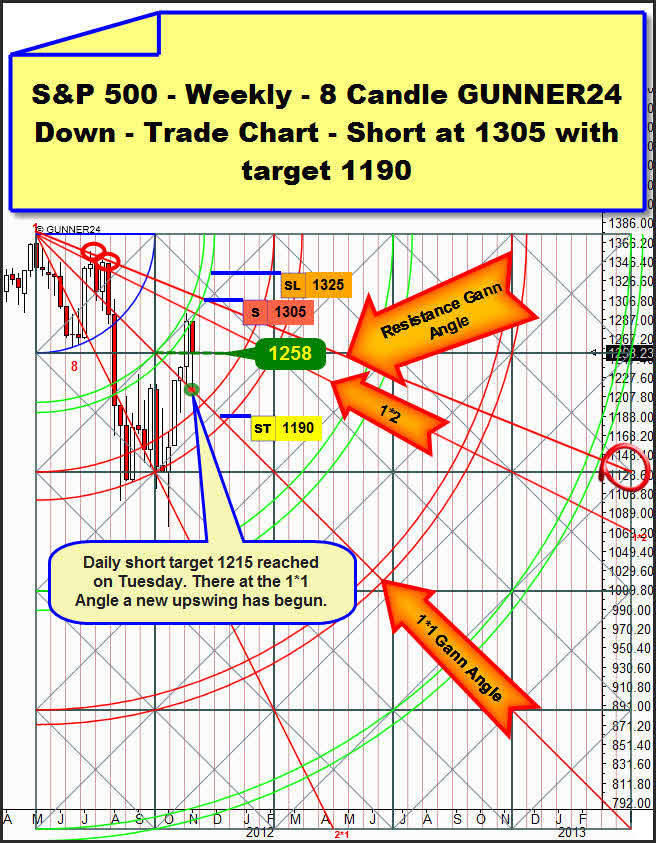

In the weekly 8 Candle GUNNER24 Down Setup we can see how the market marked its low exactly at the 1*1 Gann Angle escaping beyond the square line support at 1258. By the closing price above 1258 the market newly demonstrated that it's prepared at least to head for the 1*2 Gann Angle – in order to touch it finally. The 1*2 Gann Angle is a magnet that has got to be TOUCHED! Without this touch no significant downswing can start. But most likely the market wants to climb to the next higher level. Probably it would like to head for the resistance Gann Angle anchored outside right in the setup, at 1305. On weekly basis that one was retested twice in July already (red circles), and the definite rebound from it finally led down to the significant October lows. Now a third test is very likely, simply because it's a very, very important magnet that wants to be tested again. Here, a short-entry with good prospects is offering itself. According to W. D. Gann at a Gann Angle the rule of three and the rule of four namely take effect where we always have to reckon with some vehement moves – either with a significant rebound or with rapid trend acceleration. (On the ideal entry, please, pay also attention to rule # 24.3 in the Complete GUNNER24 Trading and Forecasting Course).

On the fine-tuning of the short-entries, even the actual daily 12 Candle GUNNER24 Down of the S&P 500 is very useful:

Here you see again the depiction of the important weekly resistance Gann Angle on daily basis. Starting from the year high it is anchored above to the right at the end of the setup by the transition from one square to the other. Also the support Gann Angle that was responsible for the rebound from the weekly low (green/red circle) is to be identified very easily. You see, the ideal short-entry is lying at about 1305 if the resistance Gann Angle wants to be reached for the third time. Talking about timing I suppose that the 1305 area shall have to be headed for, on Wednesday/Thursday after next (11/16 or 11/17, respectively)…

So, on daily basis we'll go short at 1305. The SL will be a weekly close of more than 1325. Target for the expected down move will be again the 1*1 Gann Angle in the weekly 8 Candle GUNNER24 Down: 1190.

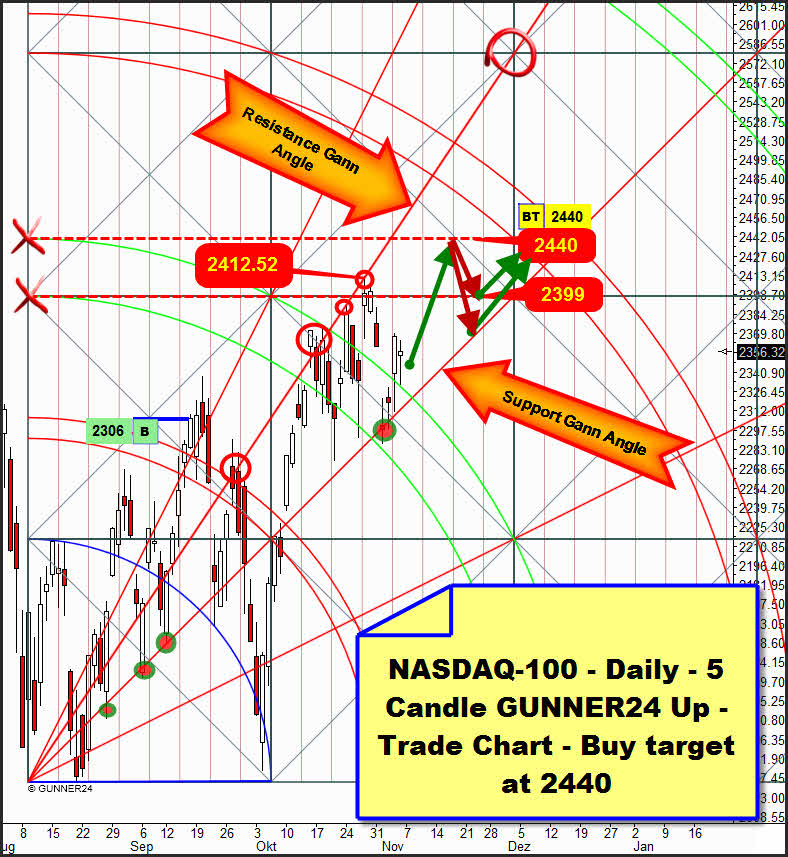

Also the actual daily 5 Candle GUNNER24 Up of the NASDAQ-100 reveals that another up-leg of the equities is due:

As usually, the NASDAQ-100 turns a little earlier than the S&P 500 and the Dow Jones. The final low of the correction occurred as early as at the beginning of August. At the low of 08/09 the 5 candle initial impulse begins. After two successful tests of the year-lows by the middle of August and beginning of October now the index is on its way to new year-highs. The temporal target of the current upwards trend is the 3rd double arc towards the trend. After the final break of the 2nd double arc the week before last, according to the rules the 3rd double arc is activated as to be the target, and it should be headed for with a 70% of probability.

Now we can work out two important things: The index is clearly swinging to and fro between the resistance Gann Angle (red circles) and the 1*1 Support Gann Angle (green/red circles). In the end the 1*1 Gann Angle supported the market last Tuesday and Wednesday again, from there the market rebounded upwards.

Furthermore, after the course high of 10/27 at 2412.52 the 2nd double arc intercepted the last rebound from the resistance Gann Angle. The market closed the week above the 2nd double arc again, thereby the preconditions keep on being present for the 3rd double arc to require being headed for. The 2440-2450 at the upper horizontal resistance line (it arises where the upper line of the 2nd double arc intersects with the starting point of the setup) seem the most likely price target. New year-high!! It looks as if the market could afterwards fall back just only to the 1*1 support again (or just onto the 2399) being able to head for the 3rd double arc with a lower high or a double top in terms of timing before being obliged to turn downwards by the end of November/beginning of December. First target then will be the 1*2 Gann Angle at 2260. At 2440 we'll cover our daily long position.

A short entry won't be useful BEFORE the 3rd double arc will be reached or touched, respectively. And it will be AFTER the 1*1 Gann Angle will clearly have been broken downwards on daily closing price basis.

0265-3070403

Presentation Related to Investment management on Internet

https://docs.google.com/present/edit?id=0AfYMfu9_czpiZHhneDk1cF8zMTRkbXc0M2Zkeg&hl=en&authkey=CKbJzusO

--

Regards,

Prasanth KS

http://www.stockforyouindia.com/

For latest stock market news,technical analysis ,live market watch,Pivot,Camarilla, Fibonacci levels visit our website.

For sure stock tips send (sms) PREMIUMHELP to 09446701641

Email- prasanthks@stockforyouindia.com

To post to this group, send email to stockforyou@googlegroups.com

For more options, visit this group at

http://groups.google.com/group/stockforyou?hl=en?hl=en

No comments:

Post a Comment